Businesses and freelancers can easily accept cryptocurrency payments. However, there are a lot of things that they need to take into consideration before doing so. Employers are required to pay salaries “in cash or a promissory note payable at par,” according to the Fair Labour Standards Act. Bitcoin, Dogecoin, Ethereum, and the others such currencies do not fall under this bar. Also, a mix of differing state laws makes crypto-based payment a hazy legal area with several stumbling blocks.

You’re a virtual assistant, a freelancer, or a digital marketer. A client recently asked about using Bitcoin to pay you. You may be unsure whether or not you should answer yes after hurriedly Searching “Bitcoin.”

While trying something new is usually a little nerve-wracking, the pros of accepting Bitcoin far surpass the cons. Note that it doesn’t have to be (and likely won’t be) your only mode of payment. As you know more about the perks of Bitcoin, you could become keener in being paid in it. In case you get paid in Bitcoin, you can trade it to make more money. However, make sure to opt for only genuine trading platforms such as oil-profit-app.com/de

Businesses and freelancers who can take bitcoin as payment must first decide whether or not to do so. There’s a lot to think about, both pros and cons.

Getting Paid in Crypto Has a Lot of Advantages

Receiving the rewards of your work in bitcoin, whether you’re a worker, a freelancer, or just a small-business owner, may make getting paid seem even better.

Pros

1. It’s easy to receive

A bank account is not needed. You won’t have to pay any foreign charges, and you won’t have to wait much to get paid. Crypto can be sent in the same way that an email can. You won’t have to worry about the high overhead costs that come with credit cards. While a little fee assures that you’ll be paid fast, you’ll still save a lot of money.

It’s easy to get started–it simply takes several hours to set up a payment API and connect your bank account. All you’ll need is a QR code if you’re selling things in person. Clients will be able to use their cell phones to send you payments directly.

2. There’s no need to be worried about fraud

If you allow credit card payments, you’re well aware of the headaches that come with chargeback fees, which are commonly the result of fraud cases. Payments can’t be cancelled or undone once they’ve been processed, therefore this is not an issue with Bitcoin.

While there are Bitcoin scams, mainly from websites that promise free Bitcoin, there are other scammers who work with other payment options. Get familiar with trusted Bitcoin wallets, trades, and mining companies. Avoid those that aren’t verified, and you’ll have a lot less to worry about when it comes to possible fraud.

3. Transactions in Real-Time

Crypto exchanges, unlike any other standard finance transaction, are seamless and reflected in the blink of an eye, regardless of where the sender and receiver are situated.

As a result, freelancers do not have to wait days for their paycheck to appear in their bank account.

4. Greater Liquidity

Bitcoins can easily be swapped for other cryptocurrencies or real money without any problems.

Furthermore, freelancers can see their earnings as an asset and convert them to fiat money as their cryptocurrency’s liquidity and worth rise.

5. Seek payouts based on the achievement of milestones

Freelancers who complete time-consuming, high-skilled work might ask for payment depending on completed milestones.

Payments depending on milestones assure that freelancers aren’t duped after the task is completed and that they have a steady stream of cash as their tasks grow.

6. Other Freelance Platforms are Available

Try services like XBT Freelancer, which provides clients as well as freelancers with Bitcoin-only transfers. For readability’s ease, all sums are listed in USD, however, you’ll be paid in Crypto. The perk of visiting Bitcoin-specific websites is that you’ll be able to see chances that aren’t offered elsewhere. You may also be paid in bitcoin, but there’s nothing mystical about the ease with which you can complete work and get paid in hours.

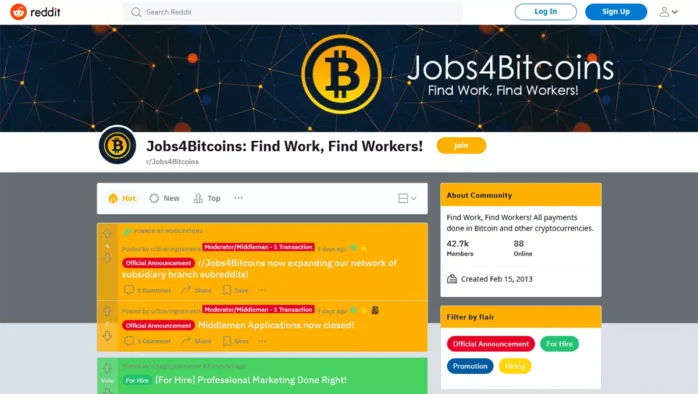

If Crypto becomes your preferred currency, you’ll like to try the Cryptogrind (which directly accesses the blockchain) and the Jobs4Bitcoins subreddit (on which you’ll see a staggering array of job options.

Cons

1. Volatility

The high inflation of bitcoin is a problem; you may notice that the price has risen, and you wait a while to let the price settle, only to discover that the price has fallen again. The main con of bitcoins is this.

Without a doubt, the price of bitcoin climbs very quickly, but it also falls very quickly. The instability of bitcoin causes bitcoin users to be wary about the currency. This is the main reason why so many investors are unwilling to invest in bitcoin.

2. Weak Security

If you own cryptocurrency, the most important thing to consider is its security. Bitcoins are useful, and attackers are always looking for a way to exploit a technical flaw and gain access to your cash or your gold. The users of bitcoin are mainly concerned with security; they are only worried about how to secure their bitcoins safe against cybercriminals.

3. Your payment’s value may change without notice

Even after adjusting for inflation, $1 now will be worth approximately the same in just a few days, weeks, or maybe even months. This is not the case with cryptocurrency, which is known for its stomach-churning instability. The rule, not an exception, is for bubbles, collapses, and dramatic price swings to occur.

On June 15, you would’ve been paid $40,406.27 if you had got one Bitcoin. Your contribution would have been valued at only $31,676.69 six days later, on June 21 – which isn’t unusual. If this had occurred with cash, this would have signalled the end of society.

Conclusion

Businesses and freelancers will definitely make greater use of bitcoin as the sharing economy comes to the fore in the future, and we may expect more innovations in this area in the future.

If we want to trade in something, we need to know both the pros and cons of it, thus after reading this article, you can decide whether or not you want to use cryptocurrencies. You may now make your own decisions about what is best for you.