You must have heard about the sad demise of the basketball legend Kobe Bryant and his daughter Gianna Bryant recently. With a net worth of $680 million, the NBA legend left a huge fortune for his family.

Though it is not clear if he had an estate plan but if he has, Bryant’s wife Vanessa who survives him would be mitigated by the spousal exemption rule and there is a huge question if the assets would pass to her tax-free or not, she and her kids would be passing through probate.

This is the best time to talk about how essential estate planning is and let us look at some examples of some celebrities who made huge estate planning mistakes.

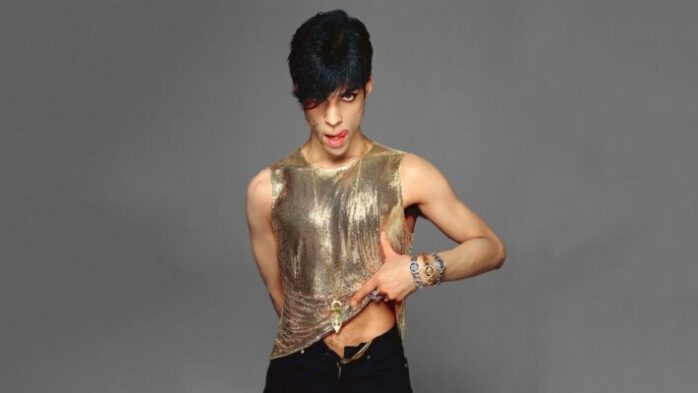

1. Prince

Some of the probable shocks that you could receive are that American musician Prince did not have a will while he met with his demise. His assets added up to some $300 million and as a result of not having a will, half of his net worth would go in as government estate tax. The other half may never go to the beneficiaries because there were none.

The lesson here: Always have a comprehensive plan drafted for you and decide whom you should distribute your assets to. Apart from that, if he would have invested a little bit of time towards planning his future assets after his demise, this would have allowed his family to minimize the estate tax. Hence, consulting an estate planning attorney about this could be a great move to make.

2. Philip Seymour Hoffman

Similarly, Philip Seymour Hoffman did draft a will in 2004 back when he had an estate value of $500,000. When he died in 2014, he had more than $35 million and children but he did not revise his will. He avoided creating a trust fund for his children because he thought this would make them spoiled.

The lesson here: The truth is, these estate plans need to be revised every few years when your net worth grows and only a lawyer can help you with this. The revisions need to be done when you have your change in assets or some major life incidents.

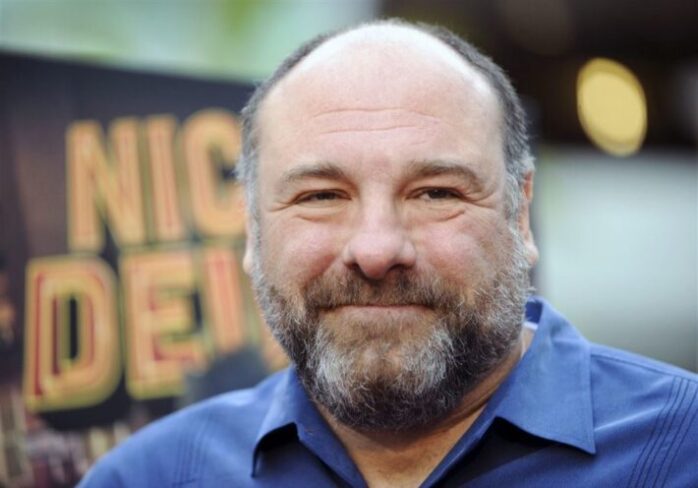

3. James Gandolfini

James Gandolfini made the mistake of not filing his estate plan with proper documents as this would help in keeping his property private. But sadly, all his estates were public because the wills were filed with the courts as public records.

The Lesson here: Be careful when you do estate planning. Have the right set of documents to file it and this will help you in the future.

4. Florence Griffith Joyner (FloJo)

The famous Olympic sprinter Florence Griffith Joyner died early in 1998 aged 38, her husband could not find her original will and he could not file it in the court within the 30 days of her demise. This was required by the California Law at that time and there were a lot of disputes between him and her mother. Joyner never filed the original will and eventually, the Judge of California Court ordered some other third party to look after her property.

The lesson here: If you wonder how he should have dealt with this situation, make sure you are well informed of the associated laws. Tell a minimum of 2 people where to find your original will. Always have two copies with you and leave the original one in your bank locker or it can be left with your trustable attorney.

While these are some of the learning we should take away, let us see one example of a celebrity who has a crazy estate plan.

Oprah, who is the media mogul, established a trust fund of $30 million for her dogs! When you compare Oprah’s total estates, this is just a little and she has pledged that all her wealth would go to charity and the bulk of her $3 billion will go into charities. She says,” to whom much is given, much should be given back.”

So what have you gathered from these mistakes? Estate Planning is what was missing and hence, you can have one plan ready for you. This plan can help you to leave a certain fortune of yours to your future generation or you can leave some specific instructions about how your successors can handle your assets or your businesses. It may not only be your assets, but it can also be how things can be handled after your demise.

If you feel alarmed and looking for an estate planning attorney, visit companies such as TaxAttorneyDaily to help you out with the process. The estate plan contains a complete set of documents that can create some ways on how to handle some future event. This can leave a specific set of instructions on how the assets can be determined. You can save a lot of time by asking your lawyer how to handle the division of your assets to the beneficiary.

There are a lot of facets you can do with estate planning and you can for sure take the help of Tax Attorney Daily. The lesson you need to learn here is that no matter how young or old you are, you need to know how to do your estate planning and if you have amassed some large fortune, you need to even more take care of this. Almost all of the Estate Planning mistakes that we have discussed here in the article are perfectly avoidable, provided you are well informed. Plans change often and it is crucial to stay updated with expert attorneys for efficient estate planning.