If you want to get the opportunities that the market offers, you need to know that anything you trade should not be left in the dark. It would be an added advantage to get entry and exit details. Before using anything, you should know everything about it in detail so that you should not face any inconvenience later on. First, you should know about the indicators to effectively know everything about it.

To clarify everything, a set of tools would assist you with the market trends. It is essential to know if the market is trending or ranging. You need to know every market trend and information.

Trading Indicator

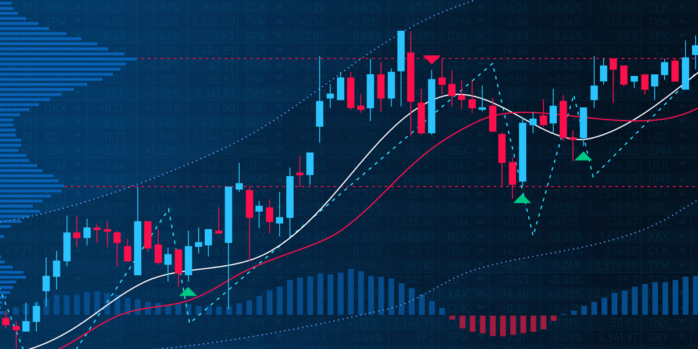

Some price charts indicate the market value of the specific area. If you look into that, you will be clear about the rise and the fall. The indicator will signal the patterns of the price so that you are aware of everything and must be prepared for things before time. This will ease your work and just by looking at the charts you will get to know everything. Many types of indicators will assist you in different ways.

If you want to know about the speeding or lagging prices, then you should go for leading indicators with which you can effortlessly measure the rate of change that is taking place in the price. If you are buying or selling the asset, then it can indicate that it is overbought or oversold.

Under the leading indicator, there is an oscillating indicator that will oscillate the prices so that you know everything about the price action taking place.

If you want to know about the trend and the market style, then the thing that will work for you is the lagging indicator. It is lagging as it does not tell about the prices; it will only help you to know about the trends and the strengths that are being followed up.

Some trending indicators will let you know about the strength and trends.

What is the most effective trading indicator?

It is important for a business that one should know everything, and it is very crucial to value your investment. So, you get the software to help you with the tradelines and the chart patterns.

Moreover, many things are done automatically, such as divergence scanning.

Some strategies are involved in buying or selling the stocks, so if anything happens, you will surely get the signals if you want to decide for the future benefits, so you should know everything is happening in the market.

To solve this issue, you have trading indicators.

If you search the things online, there will be many sites that will assist you. But you must be clear that you need to choose something practical so that you don’t face any inconveniences later on. The traders use many indicators, tradingwolf for example, but one should be safe and work accordingly so they don’t face any losses.

Which indicators should traders use?

If you are interested in any trading, you should know that indicators will calculate everything and place everything on charts so that you can get to know about it without any hassle. With this, it is beneficial to analyze anything. There are some indicators that the traders must know, so they don’t have to worry about anything before studying market trends. According to the popular choices, you will get to know what can work for you. But traders choose as per their convenience and strategies.

- The moving average indicator will inform you about the short-term trends and current prices in the market. The data will combine the prices, and everything will be available with a single line that will follow the trend.

- The other indicator is a stochastic indicator that will compare the price current and past values so that you can know the prices over time. Closing prices will inform you about the solid trends and momentum being followed up.

- Standard deviation indicators help measure the size with which the price is showing the deflections. If the price rises more, then it will show effectively. It is for you to measure the change that is taking place. You can also compare the historical prices with the current prices.

- One can identify momentum and get to know the dangerous movement in the prices with the help of the relative strength index. Now, you can figure out the changes within no time.

Trading is now made very effective and effortless with the indicators. Earlier, the traders were not getting the tools, so if they were not professional, they could not compare things. But now, with the help of the tools, a beginner can also end up trading amazingly. These indicators will assist in trading with compared values so that you will not face any losses. But some strategies also work that you can learn in some time. With this, you might be cleared of everything available in the market.

If you are trying to achieve something best in trading, then it becomes essential for you to have potential indicators that professionals design. Every time you get the signals, you need to confirm your signals with the different indicators to avoid any risks with your investments. Once your signal is confirmed, then you will get the profits. It would be best if you made some trading plans that must be implemented with these indicators. So, If you want to be an effective trader, you should not wait for anything and get the tools as soon as possible.