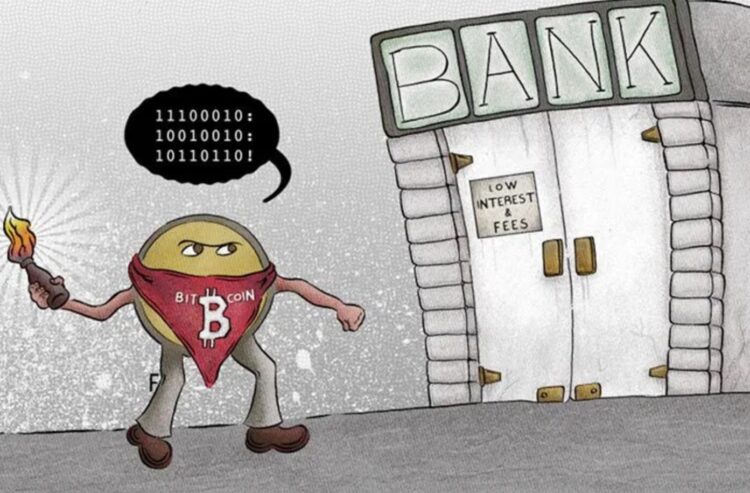

While people are becoming more interested in the market of cryptocurrencies, we can see that other financial institutions are worried about the impact that these digital assets will have on the current monetary system. Banks are especially at risk since cryptocurrencies can directly affect their dominance. On the other hand, a regular user of transaction services would rather choose a cheaper alternative, and blockchain technology provides people with the ability to have faster and safer money transfers. Besides the convenience of using an e-wallet, there are also many other advantages, like the potential to earn profit from investing in the right cryptocurrency at the right moment. You can click here to learn more about the trading processes and how to make a steady income by investing in Bitcoin.

Bitcoin represents the first and most popular cryptocurrency with a current price of around $35,000. With such a price rise, it is not a surprise that even big corporations became interested in accepting this currency as a regular payment method. Also, the expansion of online stores in recent years had a big influence on people who became more interested in improved transaction methods. There are many advantages of cryptocurrencies when we compare them to the standard banking system. For example, when you are playing games on some online gambling platform, you have to wait between two and five days to cash-out, while those online casinos that have implemented the blockchain technology can transfer your winnings instantly.

The market of digital assets is growing fast, which leads the banks to start worrying about their future. Moreover, many countries, especially those highly developed ones, are already trying to find a way how to implement blockchain technology, and banks will have to follow that trends. Chances that some of the developed countries like Japan, Denmark, or the United States will make it illegal for Bitcoin to be used are very low.

Cryptocurrencies Are Decentralized

The main difference between fiat currencies and digital coins is that this modern currency is not being controlled by any financial institution or the banks. Therefore, you can directly transfer your funds or shop online without the need to use a third party. If the trend continues and more people start using an e-wallet, the popularity of banks will rapidly fall since there will be no need to use their services anymore. Also, regular processes are much cheaper as well, and you will only need to pay a small fee when you are converting or transferring your funds.

It is Safer

There were many cases of fraud and cybercriminal where hackers managed to steal money from bank accounts. Even though they are trying to create systems with higher security, scammers are keeping the track of those updates and somehow always manage to break the security breaches. On the other side, no one can have access to your e-wallet since it is using advanced blockchain technology as protection. However, you should pay attention to never lose your security keys and passwords. There were some cases of theft related to cryptocurrencies, but they are related to online exchange platforms. That leads to the fact that you should avoid storing your coins on these websites. The most secure way is to store them on the offline electronic wallet.

Market is Growing Rapidly

With the constant rise, the market of cryptocurrencies has already managed to become bigger than some of the biggest bank groups in the world. There were some attempts from bankers to control this trend, and some banks even introduced measures where users could not buy cryptocurrencies with their credit cards. However, that lead to even bigger issues since most people decided to switch the bank after that. On the other hand, we can see that some of them are planning to introduce their models of cryptocurrencies since they are aware that virtual money will completely replace the need for using standard banking services at some moment in the future. According to some studies, fiat currencies might become completely replaced by crypto in the next ten years.

The Employment Issue

The banking system represents a big industry with millions of people in the world working as part of it. In that matter, many of them are afraid of cryptos since there is a great chance that they will have to look for another profession. The only way for banks to survive this trend is to offer some innovations and better conditions for their clients in terms of lower fees, better loans, and more.

More Affordable Option

Another reason why so many people are attracted to Bitcoin and other cryptocurrencies is that they don’t need to pay high fees when transferring money. You will only need to pay a small fee for transactions while there are no maintenance costs and other expenses that you have to pay in the bank. Besides that, the processes are much faster and you can instantly send or receive funds from anywhere in the world.

Conclusion

As we can see, some of the most popular options like Bitcoin, Litecoin, XRP, and more are constantly growing and more and more people are becoming interested in investing in them. Even though most owners of Bitcoin today are investing in it because they expect even higher value over time and to make a profit, the number of transactions made with this currency is growing as well. There is an expansion of online services where you can complete the payment with an e-wallet. Some of the big corporations are already accepting it as well, such as Home Depot, Microsoft, Twitch, Overstock, Starbucks, and more.

Considering all of those advantages, the banking organizations will have to change their strategies if they are planning to survive on the market in the future. Many countries are already looking for a way to implement cryptocurrencies in their monetary systems. The main issue with blockchain currencies is finding an efficient method of taxation since transactions are anonymous. On the other side, if the blockchain system developers manage to create a fully transparent system, the need for banks will disappear completely.