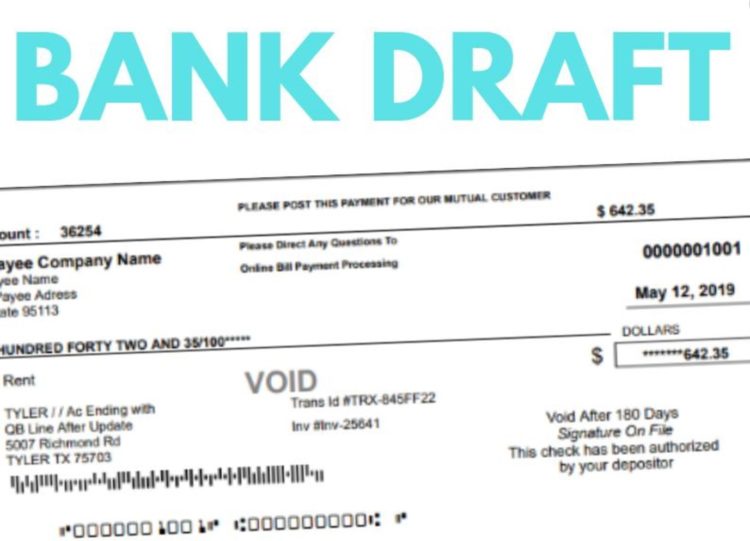

Have you ever heard about a bank draft? Do you know what it is? If you didn’t know, a bank draft is a very convenient payment method where a financial institution guarantees the funds of a payer when paying for a service or goods.

This form of paying is similar to that of a cashier’s check but is much safer. For a person to use this tool, the person must have funds available in his account. When a bank draft is issued, the financial institution effectively freezes the amount of money needed so that the transaction could be completed.

But when does this tool finds most of its use? To answer simply, this tool is mostly used in cases and situations where the person paying faces safety issues. Safety is the number one reason why this tool sees its use in modern times.

Situations Where Safety is Needed

Furthermore, we’ll explain the major situations where people mostly have safety concerns and in need of a bank draft.

· For Large Transactions

It goes without saying that everyone feels a little off when having to pay a large amount of money. Everyone has that fear in the back of their heads when needing to send or receive large sums and have the check declined.

This is where this tool comes in and helps you. This tool effectively guarantees that you’ll get paid or your payment will make do. As we said, it’s more effective and safer than a cashier’s check and has a much bigger chance that the transaction will be successful.

· For Needing to Spend the Money

If you’ve ever been paid with a check, then you’ll know that it can take up to several days for the money to appear in your account.

This is not only problematic but also very nerve-racking. When you get paid, you expect the money to instantly appear in your account. While very few methods actually make this a possibility, a bank draft drastically solves this problem.

Namely, this tool can take no more than 24 hours before the funds appear in your account. It’s faster than a check because you can spend the money since the bank guarantees them. This means that the financial establishment cannot reverse the deposit.

But why is this necessary? Well, apart from the convenient issue that everyone wants to use the money they’re being paid, this tool is heavily used for international finances, trade, and even purchasing a property such as a home.

The term “bank draft” can vary from country to country, and chances are you’ll find it under a different name in most of the countries. For example, in the United States, a bank draft can also be known as a cashier’s check – yes, the one we’ve been talking about all along.

So you should do your research before jumping on and using it for larger transactions.

Why is it Better?

According to experts at financial check printing software Chax, a bank draft must be compared to other similar forms of payment so we can discover why it’s better.

The first and most important thing to note here is the fundamental difference between a bank draft and writing a check.

When you write a check, you don’t necessarily need to have the money in the account to make the transaction. This is why any person could write a check for any amount and pay for goods and services.

The most damning thing is that the recipient of the check cannot even be sure that he’s getting any value out of the check. If the check fails, then this is what financial institutions call a “bounced check”.

While checks bounce every single day, for all sorts of honest mistakes, those that deliberately pay with checks that don’t have the available amount of money in their accounts face consequences for their actions.

With bank drafts, the term “bounce” doesn’t exist nor can exist. This is because you cannot finalize a transaction if you do not have any available funds. If you do have funds, then the financial institution effectively moves the funds around.

But as we mentioned, that could take days so the bank guarantees the receiver of the money that they will be paid. The person receiving the draft can accept the money since the money is already been removed from the payer’s account; it’s just waiting to finalize.

Is This a Really Safe Method?

When you get paid for goods and services through a bank draft, do know that you’re getting your money one way or another.

As we mentioned earlier, you cannot pay someone with a bank draft if you do not have the funds available in your account; simple as. Even if some complications occur, the financial institution guarantees you that you’ll receive the funds. What this means, in other words, is that the bank will pay you the amount if it fails to go through.

Depositing or cashing out a bank draft is done the same way you would deposit or cash out a normal check. You go to the bank, give them the draft, and your account will have the money in it in no time.

How to Get One?

Getting a bank draft is very easy and very convenient. All you have to do is simply head to a financial institution such as a bank or credit union and simply ask for one.

As we mentioned earlier, you can find it under different names so it’s best to enquire about it. You’ll mostly have to go to the teller in an institution and ask for one, and you can even request one online.

As many financial institutions only provide drafts to customers who have accounts with them, your best chance of obtaining one is to go to a financial institution that you’re a member of.

If you do have to go to a financial institution that you don’t have an account with, then you will be asked to pay for certain fees. This is often the case during an emergency, or when visiting other countries that don’t have a branch of your bank.