Real estate investors rely on several economic indicators to decide where to invest their money. When you factor in a recession caused by the coronavirus pandemic, then it is understandable that investors are being especially careful as they move forward during 2024.

The top six geographic areas being touted as the best US investment options are the Scottsdale/Phoenix area, Dallas, Atlanta, Charlotte,Virginia and Orlando.

Unlike the recession in 2008, the current recession is linked directly to the coronavirus and not to a weak economy. Once the pandemic is successfully reigned in, then the market should be in a position to recover to pre-virus days. By carefully selecting cities positioned to prosper, investment risks can be minimized.

Factors that Determine Real Estate Investment Opportunities

It is important to understand how investors decide which cities provide the best investment prospects. As a long-term investment, it makes sense to evaluate a city based on factors related to the health of the community and future prospects.

Investors need to know how fast homes are projected to appreciate in a city of interest. Comparing prices from the most previous year with current prices provides an indication of what can be expected in the future.

Rental rates and affordability are also key components that are essential for a promising real estate investment marketplace. For example, if the average salary rates in the area don’t align with the rental rates, then the market may not continue to grow.

Unemployment rates and new job prospects also contribute to any healthy local economy. As might be expected, cities with ample employment opportunities are much more attractive locales than cities with fewer prospects of working-age residents.

Another key indicator for economic health is linked to the median population age. A lower median age is considered preferable for investors since a young vibrant population is considered necessary for supporting a thriving rental market.

There are reports that the gross rent multiplier is used by investors to calculate the total number of years it takes to pay off the purchase price based on gross rents collected. Obviously, the fewer years it takes to pay off an investment, the better.By carefully selecting cities positioned to prosper, investment risks can be minimized. Find out valuable market insights for your area at Markets by DPGO for free.

1. Charlotte, North Carolina

The signs of progress and growth for the southern city of Charlotte are hard to miss. Forbes reports that The Charlotte Douglas International Airport is expanding alongside investments into bus and rail services. This growth has not gone unnoticed by real estate investors. Charlotte is an attractive hotspot due to its low tax rates, diversified economy, and healthy job market.

Additionally, Charlotte has a history of delivering consistently impressive rates of return (ROI). In the past 40 years, homes have appreciated by four percent or more for an impressive 40 year period.

The National Association of Realtors selected Charlotte as a town likely to beat the odds and continue to thrive based on the affordability of the marketplace.

Also adding to the positive image of Charlotte are population growth numbers. Money Crashers reports a 19.29% growth rate from the period of 2010 through 2018.

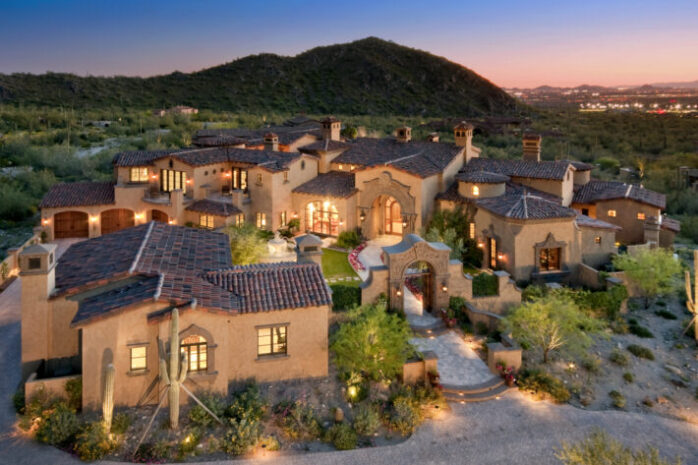

2. Scottsdale/Phoenix, Arizona

Ferguson Action reports that the Scottsdale market was recognized for its tremendous job market as one of the best in the country. In response to this impressive job growth is a promising rental market predicted to increase by as much as nine percent by Roofstock. Granted, adjustments will be made for the fallout from the pandemic.

Specifically, the Scottsdale/Phoenix area provides an excellent environment for short-term rental investment for Airbnb properties. Due to a general lack of oversight and regulation that haunts many other areas of the country over Airbnb rentals, this area allows regulations to be established by the Homeowners Associations.

It is no secret that these cities known for high living standards attract many residents who can’t afford New York or California but who desire the same high-quality lifestyle. As a result, Phoenix and Scottsdale have a shortage of rental properties which drives prices up.

Industries flock to this area seeking tax relief and fewer restrictions. The high-paying jobs these employers provide means there is plenty of money circulating for a profitable real estate investment market. The two industries that provide the stable economic backdrop supporting these positive growth figures are retail and tourism.

The unemployment rate has consistently remained lower than the country’s average. Ferguson Action claims that average employment numbers are expected to increase by an astounding 51.2%.

If you happen to be looking to sell or purchase property in the Scottsdale or Phoenix area we highly recommend you look up The Kay-Grant Group. They are one of the highest rated realtors in the area, with an excellent reputation to boot..

3. Shenandoah Valley, Virginia

If you’re looking for a resource for homes in Augusta County in Virginia’s Shenandoah Valley, then you’ll want to invest in real estate here. The top US cities to invest in real estate in 2024 include Augusta County, Virginia. This is due to the fact that the Shenandoah Valley is set to experience significant growth over the next few years. With the expansion of local businesses and an influx of new residents, the demand for housing will continue to rise. Augusta County offers a variety of homes that fit any budget and lifestyle, making it a great place to invest in real estate. There are many reasons why Augusta County is a top choice for real estate investment, so be sure to consider this location when making your investment decisions.

4. Orlando, Florida

Orlando represents an affordable, family-friendly city with lower than average costs for a home in the sunbelt. You can still buy a home for less than $200,000 in this hotspot. Based on low property taxes and insurance rates, investors are sitting up and taking notice of Orlando’s favorable rental market.

A healthy rental market where many residents prefer to rent rather than buy means a rich market for investors. The high demand has driven rental prices up as the population continues to grow. If you are looking for a hard money lender then our suggestion is to contact Capital Funding Financial.

As if these factors aren’t enough to attract eager investors, the job market continues to contribute to the optimism surrounding this city. Money Crashers reports that job growth is expected to continue at an annual rate of 3.44% for the next decade, notwithstanding minor temporary setbacks caused by the pandemic.

5. Dallas, Texas

There are many reasons that explain the attractive Dallas housing investment market. Much like the cities listed above, a welcoming business climate is a large contributor to Dallas’s prosperity and subsequent real estate investment opportunities.

Curbed reported that Dallas home prices were projected to rise 4.5% throughout 2024 prior to the coronavirus. As one of the largest cities in the U.S., the city offers low taxes and a regulation-free environment that attracts businesses to the area. Prior to the coronavirus, Ferguson Action reported the annual rate of job growth at 2.7%, a figure that is significantly higher than the 1.47% national average.

Affordability is also a reason that the Dallas investment market is so attractive to businesses, renters, and investors alike. With the average price of a three-bedroom house priced at a modest $215,000, it is easy to understand the appeal of Dallas’s housing market.

Ranked at the number 1 city for job growth during the last year and population growth of 1.7%, Dallas is ripe for continued growth and investor interest after the pandemic ceases to interrupt the economy.

6. Atlanta, Georgia

Forbes predicts that Atlanta rental rates will increase by about four percent in the next four years. This prediction is based on the success of mixed-use developments that capitalize on the desire for walkable suburban developments.

Millennials who can’t afford to live in pricey urban areas can settle a few minutes outside of downtown hubs and still reap many of the benefits of living in town. This trend is expected to continue which presents a ripe market for commercial developers.

Takeaway

While the coronavirus pandemic adds an air of uncertainty for investment prospects in the near future, vaccines predicted to arrive in the near future are sure to revive the economy and fuel continued profitable investments in real estate.

While certain cities in less attractive areas may take longer to recover, the underlying characteristics of the six cities outlined above are likely to stabilize the microeconomies of these locales and thrive.