If you just bought your car it would make sense to take care of it the best you can while providing it with the right insurance, right? How big is your budget, and how important is insurance to you? In this article, we’re going to focus on a ton of different insurance options and some insurance claim software for 2024. We will help you navigate and narrow down your selection. Keep on reading and find the best option down below!

What is digital insurance?

As the name implies, digital insurance is an insurance product offered online or through a mobile app, without the need or reason for you to leave your home and get your questions answered at the place or the facility. Nowadays, these platforms use a combination of live customer service and digital algorithms to write and price policies, and to help you out with your query. Thanks to this algorithm the process itself is a lot more smooth and fast.

How to find the best car insurance that is affordable?

Getting the most affordable car insurance rates can be tricky, but it can be your starting point if you are on a budget. No one wants to overpay for something and make a wrong move. Make sure that you pay close attention to the following list of things:

- Get your auto insurance quotes early on – always compare your options and reconsider your choice. It is best to compare different markets and different companies. You can do this step online and narrow down your selection.

- Look for some discounts – you can easily find some discount options with most sites, especially as a welcome present for choosing their service. Narrow down your selection by picking out a site that works for you.

- Look at your credit – you should always manage your money in a responsible way and pay your bills on time to boost your credit score. Take a close look at your current balance and manage your money responsibly.

4 Best auto insurance claims software 2024

1. Esurance

Esurance is a popular choice for a lot of different vehicles, but also real estate It sells auto, home, motorcycle, and renters insurance direct to consumers online and by phone. You can easily operate it on your phone and through the app that they offer. People all over the US can go with this coverage (it is available in all 50 states and DC). Esurance has been writing policies since 1999, which is why they are a trustworthy solution and a common source for a lot of people. The price will vary from $3 to $10 per month, and you should discuss any details over the phone or by email.

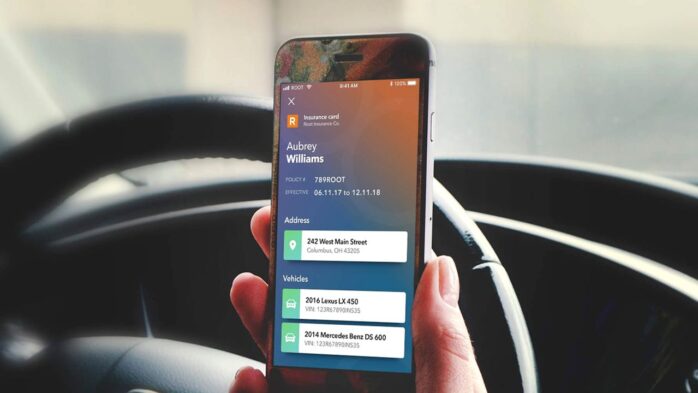

2. Root

The root is a tech-savvy auto insurance company set on directly rewarding good drivers for their good driving habits. There is a lot of perks and pros when it comes to Root, such as that you can easily manage your policy in the Root app, enjoy free Lyft credits on select holidays and even earn cash by referring it to some of your friends. The company has been around since 2015 and is a popular solution among plenty of drivers. You can get their premium car insurance once you pass the test. Root’s test drive is a two- or three-week digital trip tracker, performed through the Root mobile app directly. Once the test drive is complete and a quote is offered, you can easily buy coverage through the app via credit card or even Apple Pay.

3. Auto-Owners

Auto-Owners offers great deals, discounts, and options to drivers in 26 states. You can also enjoy a lot of unique features with them. Drivers could save by getting a quote ahead of their current policy’s expiration, or by opting for paperless billing and payment options. When you rent a car, your Auto-Owners’s policy covers as much as it does for your personal car, as well as any fees from the rental company associated with an accident. You get a discount for signing up, then the app tracks your driving behavior and provides feedback on behaviors such as how many miles you drive. Auto-Owners also offers a variety of optional coverages not included in a standard homeowners policy, often discussed with the provider.

4. Arnie Software

Claim management software that streamlines the auto repair claims process for insurers, assessors, repairers, and customers. Arnie worries about your car so you don’t have to. In fact, thanks to their user-friendly system you can easily understand what is going on with your car in real-time. You can even connect with over 14,000 registered repairers, salvage yards, and industry utilities. Arnie enables users to manage the repair process by ensuring that costs are reasonable, trusted repair methods are used to return the vehicle to pre-accident condition, changes to the scope and completion date are monitored, and all authority and evidence are captured.

FAQ about cars & insurances

1. Is car insurance required?

Car insurance is required in all U.S. states, while it can differ in other parts of the world. It is also highly recommended to have and not too pricey to consider getting. Always consult with a trustworthy company before giving it a go.

2. Are there car insurance discounts?

In some cases, you could get a discount (if you are a student, veteran, this is your first car insurance, etc). Car insurance discounts are also very popular in case you register 2-3 cars under your name.

3. What are the different types of car insurance coverage?

Coverage options always vary and depend on your chosen provider. In most cases, car insurance can cover:

- Body injuries

- Property damages

- Collision coverage

- Motorist coverage

- Personal injury protection

Always customize the insurance per your needs and per your preference and budget. We have that this list has helped you out and that we’ve answered some of your questions when it comes to insurance or automated software.