At the state level, not at the federal level, the insurance is governed by statute. A very clear and important inference follows from this.

Conclusion number 1: only an insurance professional in your state can send you details. You can trust Some information for other states outside these countries could be inapplicable. For example, our story will be conducted in relation to the state of California.

Do You Really Need to Get Car Insurance?

Auto insurance is required for liability (civil liability) in nearly every country (with some exceptions) if a stranger is injured by us. Depending on the region, the coverage required varies. It, for example, amounts to $15,000 in a single victims’ bodily injury and more than $30,000 in a total of $15,000 in California. Therefore, liability shall be charged-$ 5,000 for any harm to the property of another person. Much of that is unintentionally measured. The fractions are usually used for representing the dimensions of the coverage. The 15/30/5 record corresponds to the California coverage described above that every driver is required by state law to have.

You can also read information about car insurance in Georgia on general.com.

Driving without insurance is a serious crime and severely punished.

Advice: Never enter into any relationship with people who drive a car without insurance or argue that it is possible, justify why this type of crime is okay. These people are on their way to big trouble – no need to keep them company.

28-30% of drivers have no insurance at all, according to police estimates in the State of California. Include the same proportion of individuals with the minimum legal coverage and you will know that there is virtually no risk of collecting funds from the culprit if you have any real repercussions down the road.

Conclusion number 2: you cannot expect that in case of trouble you will be covered by someone else’s insurance – you need to have your own.

States are divided into:

- At Fault (for example, California – the victim is paid by the insurance responsible for the accident);

- No-Fault (example, Arizona – regardless of fault, your insurance will cover your damage).

Conclusion number 3: you need to know what is the system in the state, where you live, or are going to live.

If a person is practically broke and is going to remain practically broke for the rest of his days, then driving without insurance does not bother him financially – he has nothing to take. In all other cases, the amount of insurance must protect the driver from the seizure of his property and income (including future income) by the court.

Besides, when discussing why a driver needs to be insured, we must know that there are even if the car without insurance is possible by the law of the state, it is always better to insure your car in case of an accident.

Different Types of Car Insurance

After making certain conclusions, it would be good to talk about different types of car insurance. The purpose and benefits they can bring are different. By knowing them, you can easily understand which one matches your needs.

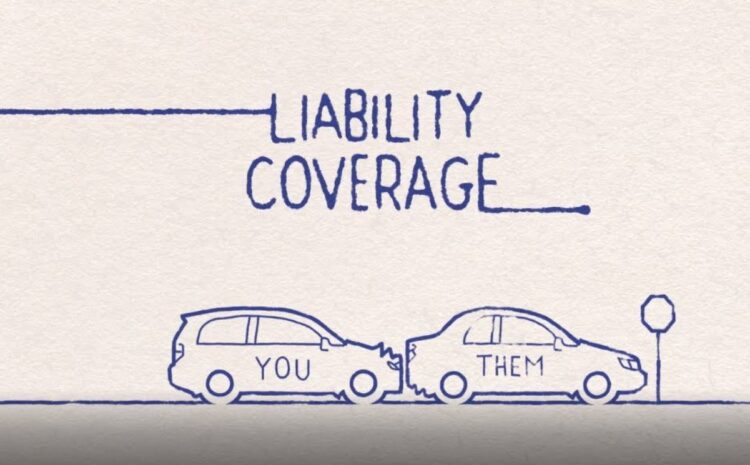

Liability Coverage

We already mentioned liability coverage in the text above. As we said, this insurance is mandatory in almost every state across the US. Each driver will have to purchase the minimum amount of liability coverage and that minimum is set up by the state law. Two components of the coverage are bodily injury liability and property damage liability.

Comprehensive Coverage

This type of insurance is different from the previous one. It helps drivers cover car damage caused by hail, fire, or theft. Also, all costs will be covered if your vehicle is a victim of the vandalism.

For instance, let’s imagine that your vehicle is damaged by a covered peril. In that case, comprehensive coverage will cover all the repair and replacement costs.

We don’t want to say this type of insurance is mandatory. On the contrary, it is optional, but recommendable at the same time.

Collision Coverage

Let’s imagine that you participated in a car accident with another vehicle. This type of insurance will help you cover all the costs that you will have to repair your car. It also allows you to replace the entire vehicle if the damage is huge. In that case, you will get the money for its actual value minus your deductible. The same counts if your car has been hit by an object like a fence.

Just like the previous coverage, this one is completely optional. Some people don’t want to use it because it can cause additional expenses. However, after reading the benefits you can get, we are sure you will change your way of thinking.

Still, we need to highlight that lender or leaseholder may require from a driver to have this coverage. This is one more reason why you should have it.

Medical Payments Coverage

Many users of this coverage will tell you it is a “multi-practical” type of car insurance. However, we truly hope that you won’t need it ever. It doesn’t truly matter who is driving the insured vehicle. The driver can be anyone who is your family member. When some of them, including passengers, get hurt in a car accident, this coverage will cover all the medical costs.

It is hard to predict if all the costs are going to be covered. However, expresses like surgery, hospital visits, and X-rays won’t be your concern. In some cases, this coverage is optional, while in some states you need to have it. We recommend you precisely research the law and see if you must have it.

Personal Injury Protection

We need to highlight that PIP (Personal Injury Protection) is not available in every state. However, it is similar a lot to Medical Payments Coverage. It helps victims of the car accident cover all the medical expenses. However, this type of insurance has one additional benefit. It can cover certain costs that were somehow connected with the injuries. For instance, it can cover child-care costs or simply lost income during recovery time.

In some states where PIP is available, all drivers need to have it by law. On the other hand, in some states, it is optional but strongly recommendable.